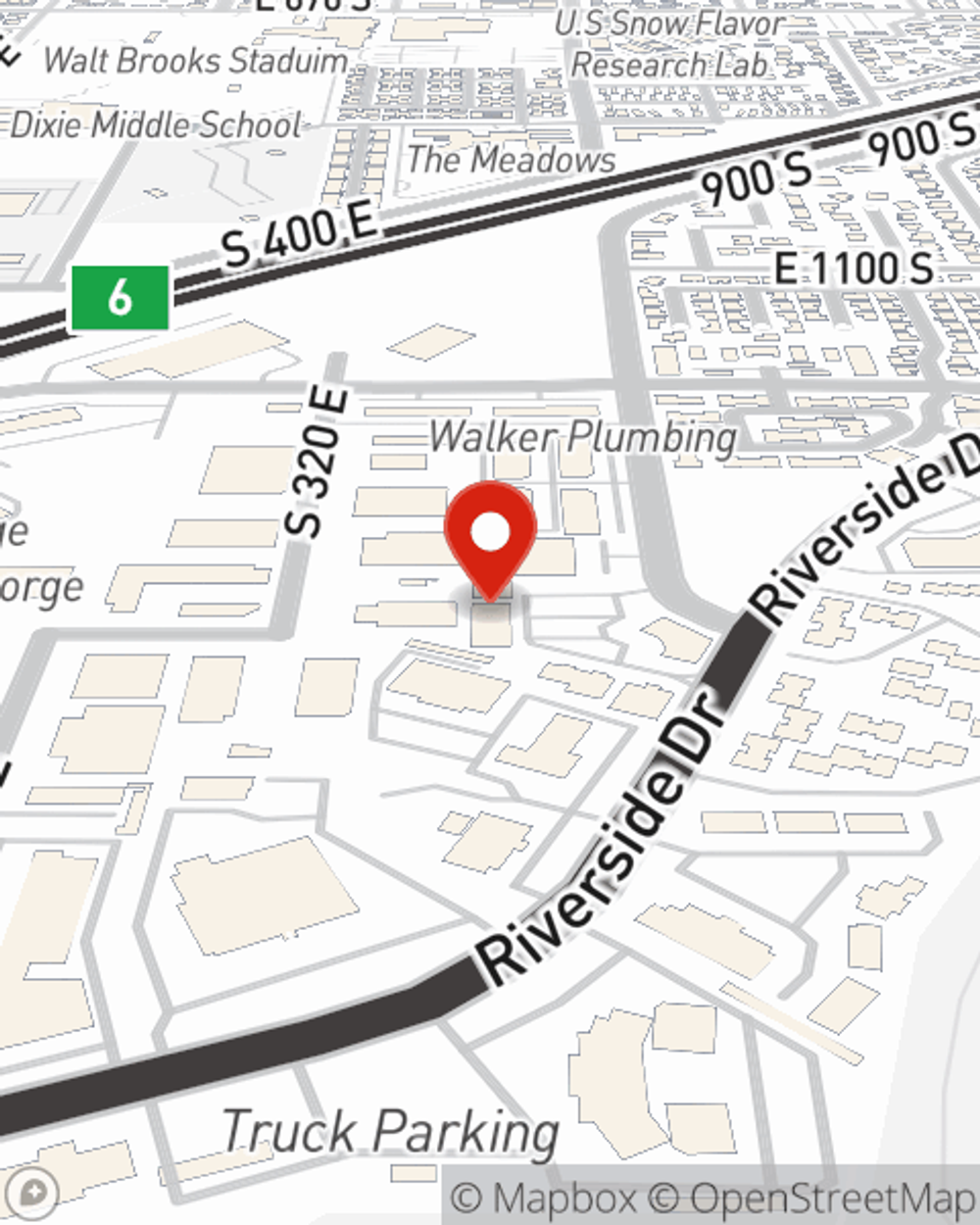

Business Insurance in and around St George

One of the top small business insurance companies in St George, and beyond.

Helping insure small businesses since 1935

- St. George

- Washington City

- Hurricane

- Leeds

- Santa Clara

- Dammeron Valley

- Washington County

- Iron County

- Mesquite

- Las Vegas

- Utah

- Nevada

- Arizona

- Salt Lake City

- Provo

- Ogden

- Cedar City

- Kanab

- Colorado City

- Fredonia

- Beaver Dam

This Coverage Is Worth It.

When you're a business owner, there's so much to remember. You're in good company. State Farm agent Seth Porter is a business owner, too. Let Seth Porter help you make sure that your business is properly protected. You won't regret it!

One of the top small business insurance companies in St George, and beyond.

Helping insure small businesses since 1935

Small Business Insurance You Can Count On

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your pay, but also helps with regular payroll expenditures. You can also include liability, which is crucial coverage protecting your company in the event of a claim or judgment against you by a customer.

At State Farm agent Seth Porter's office, it's our business to help insure yours. Visit our wonderful team to get started today!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Seth Porter

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.