Life Insurance in and around St George

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- St. George

- Washington City

- Hurricane

- Leeds

- Santa Clara

- Dammeron Valley

- Washington County

- Iron County

- Mesquite

- Las Vegas

- Utah

- Nevada

- Arizona

- Salt Lake City

- Provo

- Ogden

- Cedar City

- Kanab

- Colorado City

- Fredonia

- Beaver Dam

Protect Those You Love Most

Purchasing life insurance coverage can be a lot to ponder with a variety of options out there, but with State Farm, you can be sure to receive considerate dependable service. State Farm understands that your goal is to help provide for the people you're closest to.

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Agent Seth Porter, At Your Service

When applying for how much coverage you need, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like how old you are, your health status, and perhaps even family medical history and body weight. With State Farm agent Seth Porter, you can be sure to get personalized service depending on your unique situation and needs.

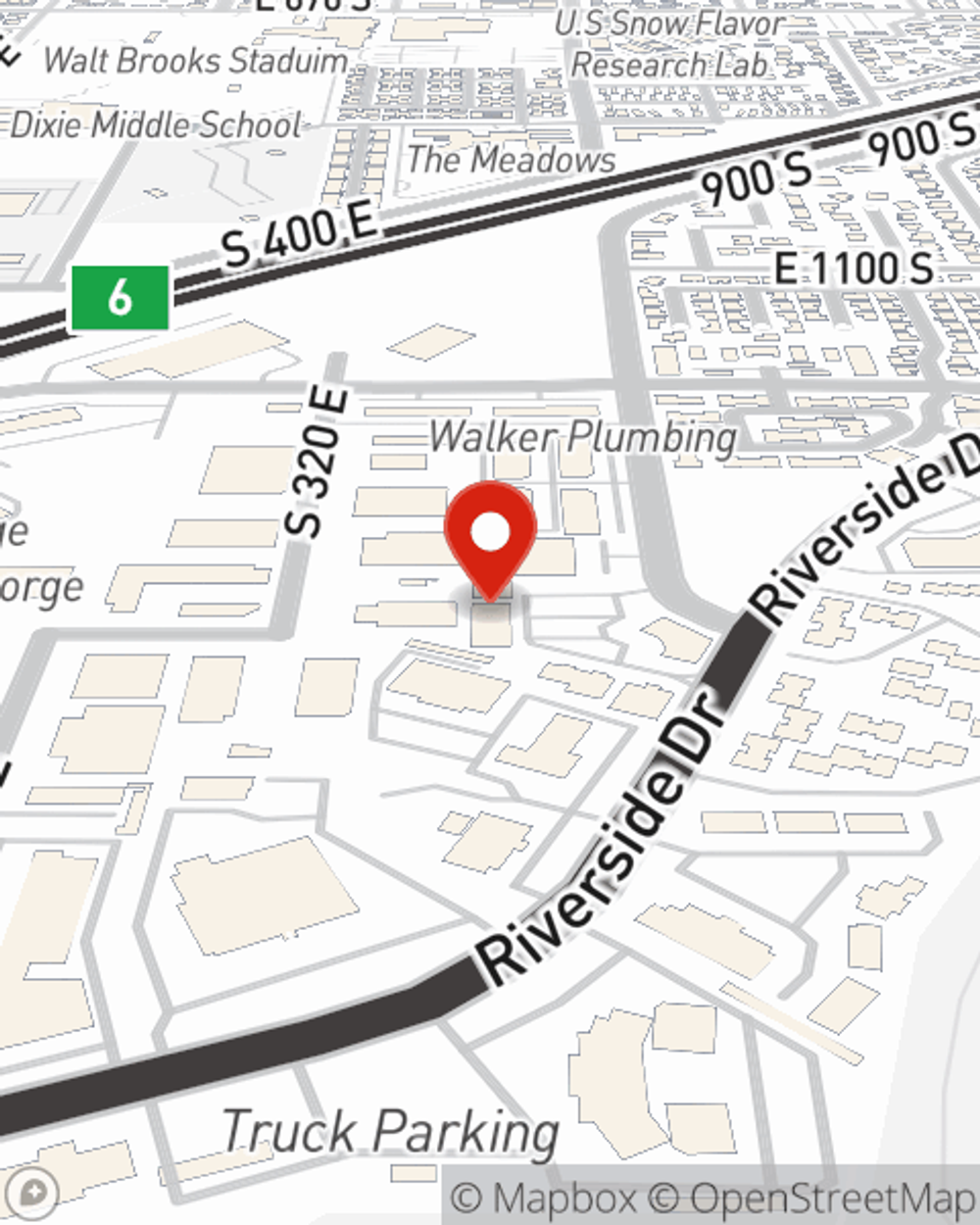

It's always a good idea to make sure your loved ones have coverage against the unexpected. Visit Seth Porter's office to find out your Life insurance policy options.

Have More Questions About Life Insurance?

Call Seth at (435) 275-0371 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

Seth Porter

State Farm® Insurance AgentSimple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.